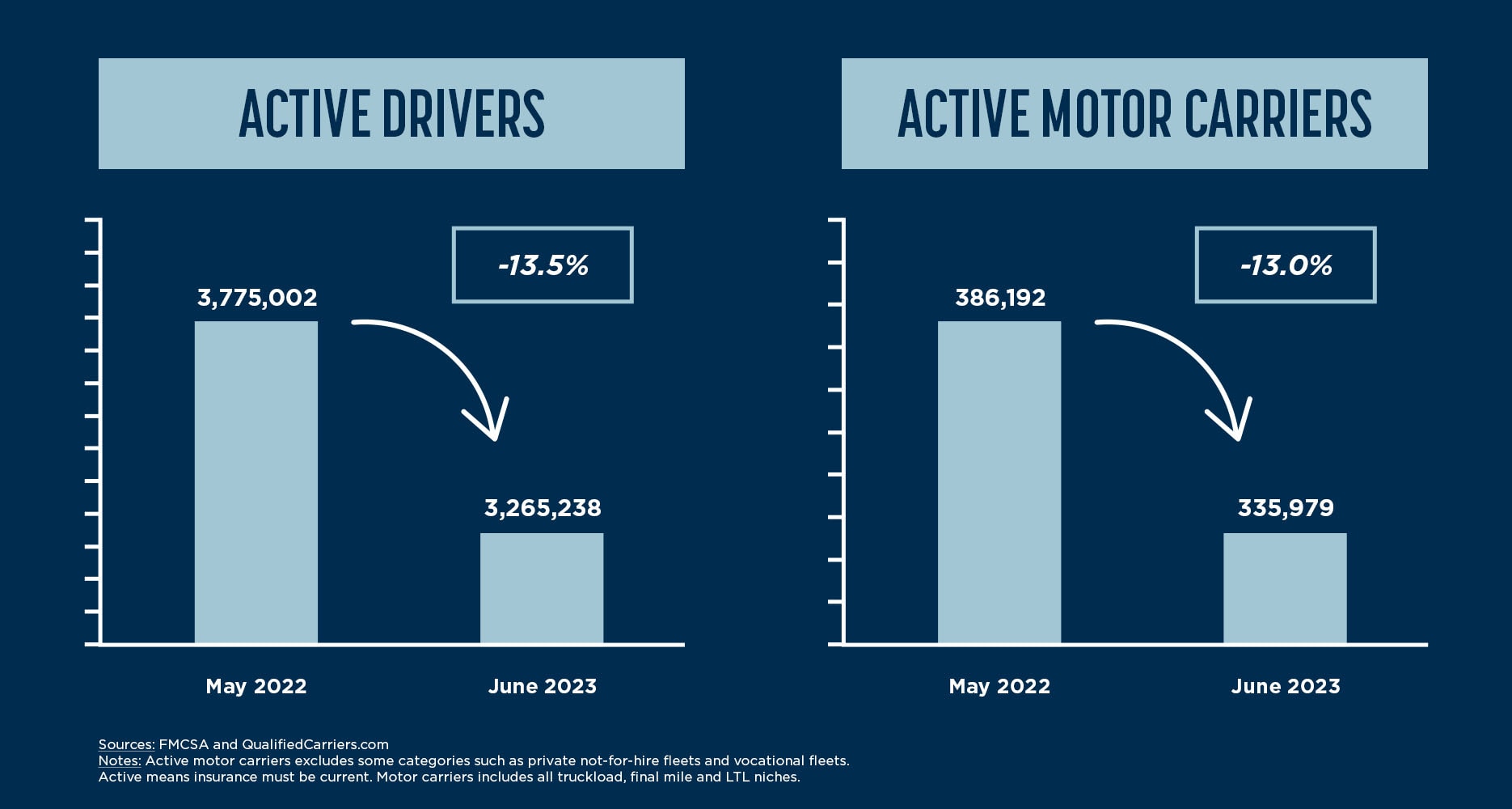

Data from FMCSA and others suggest that over the last 14 months, more than 50,000 fleets have stopped operating and around 510,000 drivers have left the industry. Others say that the driver shortage is not real—instead, the number of “small” fleets, which account for roughly 85% of the market, are actually growing in number, and the drivers that do leave are just making the jump from owner operators to larger companies. To top off the confusion, rates are down and costs are up across the board. These drastic changes, coupled with the news of Yellow’s bankruptcy, have left many in a state of panic over the future of freight. One day the news says there’s a dwindling capacity and the next day it says capacity is too high. We know that large fleets make up a significant piece of the market… But do they also drive the narrative?

While good for headlines, Yellow’s fall is not truly representative of the current issues facing the market—their bankruptcy, for the most part, was purely based on business economics, stemming from too much debt, union pay, and lack of integration of acquired companies.

For the rest of the freight industry, the change is a normal part of the truckload market cycle, albeit one hit particularly hard by the lingering effects of the pandemic. That said, the current “freight recession” is significant, and LTL carriers are being pushed out as FTL companies struggle to make ends meet.

The causes for this shift are twofold:

Capacity – During COVID and up until late 2022, trucking companies continued to buy assets (trucks and trailers) to meet demand. Demand has slowed in the last 12 months, causing a buildup of assets and leading to excess capacity.

Current Costs – All trucking companies have different operating costs, but none of them can survive forever on low rates. Throughout this year, truckload spot rates for dry van have hovered between $1.50 and $2.10 a mile. Meanwhile, the average breakeven cost per mile for truckloads ranges from $1.56 to $1.90 per mile, according to a recent J.P. Morgan study. Combine this with low freight rates and higher diesel prices, and many trucking companies around the nation are left in the red, big players included. Earnings calls this year for the public carriers have been short on good news. Private carriers are holding on or parking the fleet. It’s not great.

So what can we expect in the coming months?

More Small Fleets Will Close Down, More Will Come on Board

Just like Yellow, these fleets will be absorbed by larger, more stable carriers like FedEx and XPO at higher prices. This will become the new normal during this period of adjustment. Eventually, carrier capacity will normalize and get rates back to where they need to be, and new fleets will spin up.

3PLs Will Be Affected

In an ideal market, shippers have a healthy mix of contract, dedicated, and spot freight to keep things flexible. Right now, the scales are tipped in the shipper’s favor on contract rates. This means that FTL freight is being primarily moved for contract prices, there is less spot freight, and brokerages don’t have much of a chance to sell the services of small fleets.

Since 3PLs are essentially the sales force for small carriers, they’re negatively impacted by this change. Some are just parking a portion of their fleet to ride out the storm. Many small fleets bow out completely, and 3PLs are left searching for good carriers to provide good services.

What is HPL doing to help?

HPL Logistics’s freight brokerage division puts an emphasis on partnering with quality carriers. With all the market volatility and uptick in fraudulent carriers, we looked inward to improve our carrier operations by increasing our vetting, upgrading technology, and committing to dedicated solutions for our customers, all of which leads to a better overall customer and carrier experience.

Our transport division is growing to meet customer demand while weathering this freight cycle. With costs up more than 30% year over year and rates down roughly the same amount, we have been running critical lanes for our customers and trying to break even when we can at HPL Transport. It’s hard because even a 10-20 cent uptick in fuel cost per gallon eats into any profit. That’s why many owner operators are parking their equipment. But we started HPL Transport to support our partners on lanes that were important to them, so we do our best to accommodate.

Adam Ferguson

President and CEO

Need help moving or storing temperature-controlled or time-sensitive dry goods? Send us a message.